The Oracle Problem Still Hasn't Been Solved and It's Getting Worse

Every time you borrow on Aave, trade a perpetual on GMX, or mint a stablecoin on Maker, you're trusting an oracle. A piece of off-chain infrastructure that tells on-chain contracts what prices are.

If the oracle says ETH is $1,958, your positions are safe. If the oracle says ETH is $100 for even a few seconds, billions in liquidations trigger. Positions get wiped. Protocols accumulate bad debt. And there's nothing the smart contracts can do about it because they believed the price they were told.

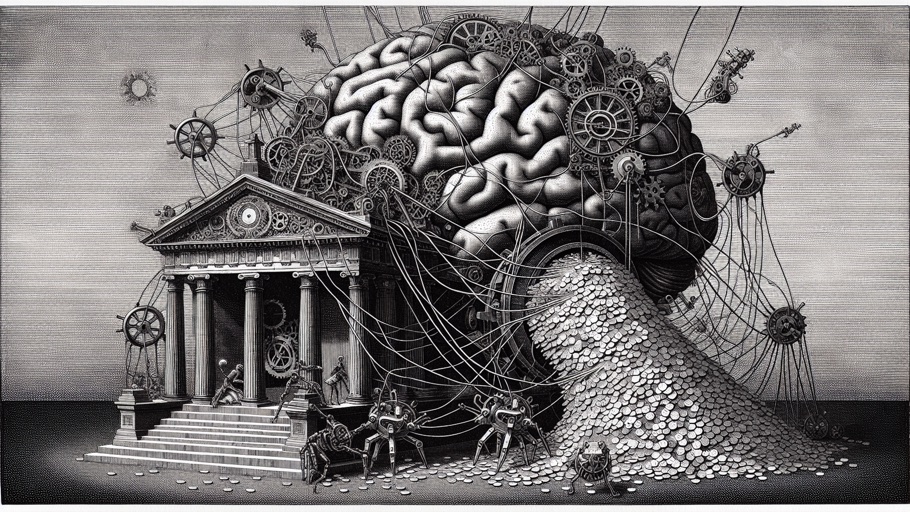

The oracle problem is the biggest unsolved issue in DeFi. And as the ecosystem grows, it's only getting worse.

What the Oracle Problem Actually Is

Blockchains are deterministic. Every node processes the same transactions and arrives at the same state. This is what makes them trustless and verifiable.

But real-world data, things like the price of ETH, the value of US Treasuries, weather data, sports scores, isn't on-chain. Someone has to put it there. That someone is an oracle.

The problem is fundamental: how do you get trustworthy off-chain data into a trustless on-chain system without introducing a point of trust?

Every solution involves trade-offs. And every trade-off creates attack vectors that scale with the value secured by the oracle.

Chainlink's Dominance (and Its Limitations)

Chainlink is the dominant oracle provider, and it's not particularly close. Most major DeFi protocols, including Aave, Compound, Synthetix, and dYdX, rely on Chainlink price feeds as their primary or exclusive oracle.

Chainlink works through a network of node operators who fetch price data from exchanges and aggregate it. The median of their reports becomes the on-chain price. There's economic incentives (LINK tokens) for honest reporting and penalties for misbehavior.

It works well enough most of the time. But "most of the time" isn't good enough when billions of dollars depend on it.

Latency. Chainlink updates prices based on deviation thresholds (typically 0.5-1%) or heartbeat intervals (typically every hour). During a flash crash, the on-chain price can lag the real market price by minutes. Those minutes can mean the difference between orderly liquidations and bad debt.

Cost. Operating Chainlink feeds is expensive. Node operators need to submit on-chain transactions for every price update. On Ethereum L1, this costs meaningful gas. The result is that Chainlink feeds update less frequently than ideal, especially for smaller asset pairs.

Centralization. Despite being called "decentralized oracles," Chainlink's node operator set is curated by the Chainlink team. The multisig that controls upgrades and node membership is a centralized point of trust. This isn't a secret, but it's often downplayed.

Single point of dependency. When Chainlink is the oracle for virtually everything, a Chainlink failure is a DeFi-wide failure. There's no diversification at the infrastructure level, even if individual protocols are decentralized.

The Attacks Keep Coming

Oracle exploits are one of the most common attack vectors in DeFi. The pattern is depressingly consistent:

- Attacker manipulates the price of a thinly traded token on a DEX

- Oracle reports the manipulated price

- Attacker uses the inflated price to borrow against their holdings

- Attacker withdraws the borrowed funds and defaults

- Protocol is left with bad debt

This has happened dozens of times. Mango Markets lost $114 million to an oracle manipulation attack. Numerous smaller protocols have been drained through similar exploits.

And it's getting worse, not better. As DeFi deploys to more L2s and alt-L1s, oracle infrastructure is being stretched thinner. Smaller chains have less oracle coverage, longer update times, and fewer data sources. These are exactly the conditions that make manipulation easier.

The New Generation of Oracles

The market hasn't been standing still. Several new approaches are trying to solve what Chainlink hasn't.

Pyth Network. Originally built for Solana, Pyth takes a different approach. Instead of third-party node operators fetching prices, Pyth gets data directly from first-party sources, exchanges, market makers, and trading firms. The logic is that the entities with the best price data should provide it directly. Pyth has expanded to dozens of chains and supports over 500 price feeds.

Uniswap TWAP. Uniswap V3 pools include built-in time-weighted average price (TWAP) oracles. Because the price data comes from actual on-chain trades, there's no off-chain dependency. The downside is that TWAP oracles are vulnerable to manipulation on low-liquidity pairs and can lag during volatile periods.

API3. This project uses "first-party oracles" where the data providers themselves run oracle nodes, rather than relying on third-party intermediaries. It removes one layer of trust but introduces dependency on the data providers' infrastructure.

RedStone. A modular oracle that delivers data on-demand rather than pushing it on-chain continuously. This reduces costs but requires protocols to integrate differently than they would with Chainlink's push model.

Chronicle. Originally built for MakerDAO, Chronicle is trying to be the oracle infrastructure for Ethereum's rollup ecosystem, with a focus on L2-native data delivery.

Why the Problem Is Getting Worse

Several trends are making the oracle problem harder, not easier:

More asset types need oracles. It's not just crypto prices anymore. RWA tokenization means oracles need to report the value of real estate, bonds, commodities, and private equity. These assets don't have 24/7 liquid markets. Pricing them accurately and frequently is fundamentally harder.

Cross-chain complexity. A DeFi protocol on Arbitrum might use collateral whose price is determined by trading on Ethereum L1. Getting that price to Arbitrum accurately, quickly, and cheaply requires cross-chain oracle infrastructure that's still immature.

MEV and oracle racing. Block builders and searchers are increasingly using oracle update transactions as MEV opportunities. They front-run oracle updates to liquidate positions or manipulate prices in the window between the real price change and the oracle update. This "oracle-extractable value" is a growing problem.

Liquid staking and restaking tokens. Pricing stETH, eETH, and other derivative tokens accurately is harder than pricing ETH. These tokens have their own market dynamics, depeg risks, and redemption mechanisms that make oracle pricing complex.

What Needs to Happen

I don't think there's a single solution. The oracle problem is going to require a combination of approaches:

Diversification. No protocol should rely on a single oracle provider. Aave using Chainlink exclusively is a systemic risk. Protocols should implement fallback oracles, multi-oracle systems, and circuit breakers.

On-chain price discovery. As DEX liquidity deepens, on-chain TWAP oracles become more manipulation-resistant. Protocols should incorporate on-chain price data as a check against off-chain oracle feeds.

Economic security scaling. Oracle security needs to scale with the value it secures. If a Chainlink feed secures $10 billion in DeFi positions, the cost of corrupting that feed should be prohibitively expensive. Currently, the economics don't always align.

Latency improvements. Oracle updates need to be faster, especially on L2s where block times are short. A 1-hour heartbeat made sense when Ethereum blocks were 13 seconds. It doesn't make sense on L2s with 2-second blocks.

My Take

The oracle problem is DeFi's dirty secret. We've built a $100+ billion financial system on top of infrastructure that's centralized, fragile, and regularly exploited. And most users have no idea.

Chainlink works well enough for now. But "well enough" becomes inadequate as the stakes get higher. When DeFi secures trillions (not billions), oracle failures won't just wipe out a protocol. They'll make headlines in the Wall Street Journal.

The protocols that take oracle risk seriously, by diversifying providers, implementing fallbacks, and participating in oracle governance, will be the ones that survive the next crisis. The ones that just plug in a Chainlink feed and forget about it are building on sand.

This is one of those boring infrastructure problems that nobody wants to talk about until something breaks. And when it breaks, everybody will ask why we didn't fix it sooner.

Related Articles

An AI Wrote the Code That Just Drained $1.8 Million From a DeFi Protocol

A pricing glitch that lasted only minutes left DeFi lender Moonwell with $1.8 million in bad debt. The faulty code was co-authored by Claude Opus 4.6, an AI coding assistant. We've officially entered the era of AI-generated exploits.

Solana Memecoins Crashed but the Ecosystem Is Stronger Than Ever

The memecoin mania on Solana burned billions. But underneath the wreckage, the chain's infrastructure, DeFi, and developer ecosystem are in the best shape they've ever been.

DeFi Is Not Dead. It's Just Getting Boring.

Everyone says DeFi is dead because the 1000% APYs disappeared. The truth is DeFi is actually working now. It's just not exciting anymore. And that's the point.