Restaking Is the Hottest Trend in Crypto and the Riskiest

If you hang around crypto long enough, you start to notice a pattern. Whenever yields compress, the market invents a new way to stack risk for higher returns. Yield farming in 2020. Olympus forks in 2021. Luna's Anchor protocol in 2022.

In 2024-2026, the hot new thing is restaking. And it has over $18 billion in TVL to show for it.

What Restaking Actually Is

The concept is elegant. You've already staked your ETH to secure Ethereum. You're earning about 3% APR. Restaking lets you take that same staked ETH and simultaneously use it as security for other protocols, networks, and services.

EigenLayer, created by Sreeram Kannan, is the pioneer and dominant player. It sits between Ethereum's staking layer and a collection of "Actively Validated Services" (AVSs), which are essentially protocols that need their own security but don't want to bootstrap a validator set from scratch.

Think of it like this: you're a security guard at a bank (Ethereum staking). Restaking is moonlighting as a security guard at three other buildings in the same neighborhood during the same shift. You earn more money. But if something goes wrong at any of those buildings, you face consequences at all of them.

The Numbers Are Staggering

EigenLayer has accumulated over $18 billion in TVL, making it the third-largest protocol in all of DeFi. The growth has been exponential, going from a few hundred million to billions in under a year.

Liquid restaking protocols like ether.fi have also exploded. Ether.fi Stake alone holds over $10 billion in TVL. These protocols wrap EigenLayer deposits into liquid tokens (like eETH), which can then be used in DeFi. So you're staking, restaking, AND using the liquid restaking token as collateral.

The yield stack looks something like:

- Ethereum staking yield: ~3%

- EigenLayer AVS rewards: variable, maybe 1-5%

- Liquid restaking token yield (from DeFi usage): variable

- Protocol token incentives: variable

Total potential yield: 5-15%+

Compare that to vanilla ETH staking at 3%. It's easy to see why money is flowing in.

The Risk Stack Nobody Talks About

Every layer of yield adds a layer of risk. Let me walk through them.

Slashing risk on Ethereum. This exists for regular staking. Misconfigure your validator, and you lose ETH. It's rare but real.

Slashing risk on AVSs. This is the new one. If you're restaked to an AVS and that AVS detects misbehavior (or has a bug in its slashing logic), your restaked ETH can be slashed. You're now exposed to slashing conditions on multiple protocols simultaneously.

Here's the scary part: most restakers don't know what AVSs their ETH is securing. They deposited into EigenLayer or a liquid restaking protocol, selected "max delegation," and moved on. They're bearing the slashing risk of protocols they've never heard of.

Smart contract risk, multiplied. Regular staking involves Ethereum's consensus mechanism. Restaking involves EigenLayer's contracts, the AVS contracts, the liquid restaking protocol contracts, and any DeFi protocol where you're using the liquid restaking token. One bug in any of these layers, and the whole stack collapses.

Correlation risk. If multiple AVSs experience issues simultaneously (say, during a market crash when the protocols they're securing are under stress), the slashing events could cascade. Your single deposit of staked ETH could face slashing from multiple directions at once.

Liquidity risk. Liquid restaking tokens like eETH trade on secondary markets. In normal times, they trade close to the value of the underlying ETH. During a crisis, they can depeg. If you're using eETH as collateral in a lending protocol and it depegs, you get liquidated. This is exactly what happened with stETH during the Luna collapse, and liquid restaking tokens are even more complex.

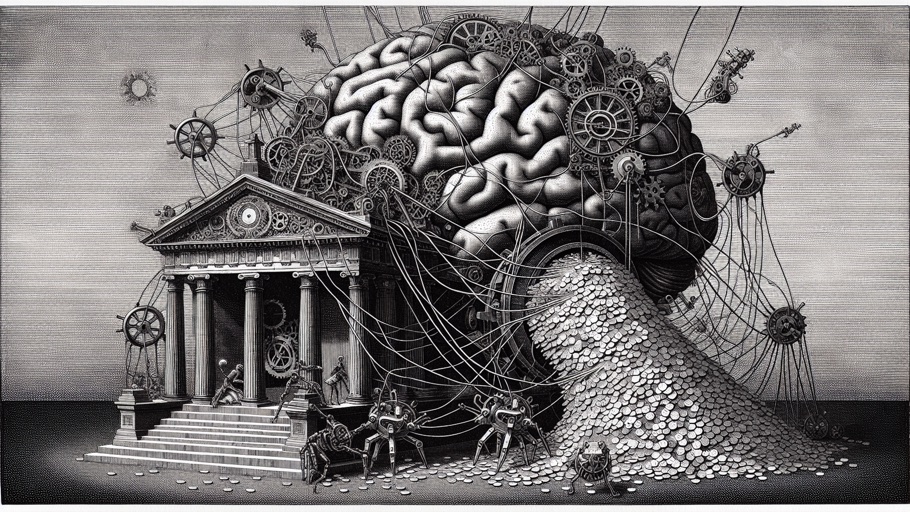

The Rehypothecation Parallel

Restaking is essentially rehypothecation, the practice of using the same collateral for multiple obligations. Wall Street has been doing this for decades. It's how you get leverage in the traditional financial system.

The 2008 financial crisis was, in large part, a rehypothecation crisis. The same mortgage-backed securities were pledged as collateral across multiple institutions. When the underlying mortgages defaulted, the cascading margin calls brought down the entire system.

I'm not saying restaking will cause a crypto version of 2008. But the structural similarity is worth noting. When one asset backs multiple security guarantees, the failure mode isn't linear. It's exponential.

EigenLayer's Defense

The EigenLayer team isn't naive about these risks. They've built in several mitigating mechanisms:

Operator selection. Restakers can choose which operators to delegate to, and operators can choose which AVSs to validate. In theory, sophisticated operators will avoid risky AVSs.

Gradual rollout. AVS slashing isn't fully live yet. The protocol has been deliberately cautious about activating slashing conditions, giving the ecosystem time to mature.

Insurance markets. There's an emerging market for restaking insurance, where protocols and users can buy protection against slashing events.

But these safeguards rely on the assumption that operators and restakers are sophisticated enough to assess risk. The reality is that most TVL in EigenLayer came from people chasing points (potential airdrop allocation), not from people carefully evaluating AVS risk profiles.

The Points Game

Let's be honest. The majority of EigenLayer and liquid restaking TVL was deposited for points, which were widely expected to convert into token allocations.

EigenLayer launched its EIGEN token. The airdrop happened. And what happened next is what always happens. A significant chunk of TVL left. The farmers collected their tokens and moved on.

The question now is whether the TVL that remains is "real" or whether it'll continue leaking as token incentives dry up. If EigenLayer can maintain $15-18 billion in TVL based on actual AVS yield rather than airdrop speculation, that's genuinely impressive. If TVL drops to $5 billion, the narrative shifts from "hottest trend" to "another yield farming fad."

What You Should Do

If you're restaking, here's my honest advice:

Understand what you're securing. Look at the AVSs your operator is validating. What do they do? What are the slashing conditions? If you can't answer these questions, you're taking blind risk.

Don't use liquid restaking tokens as collateral. The temptation to deposit eETH into Aave and borrow against it is strong. Don't. The liquidation risk during a crisis is extreme. You're layering leverage on top of an already leveraged position.

Size it appropriately. Restaking should be a small portion of your ETH holdings, not all of it. The yield premium over vanilla staking isn't worth the incremental risk if your entire position is restaked.

Watch for slashing activation. When full slashing goes live on EigenLayer, the risk profile changes dramatically. Stay informed about the timeline and conditions.

My Take

Restaking is a real innovation. The idea of using existing economic security to bootstrap new networks is clever and capital-efficient. EigenLayer solved a real problem.

But the yield chase has gotten ahead of the risk management. Too much capital has piled into a system that most depositors don't understand, chasing yields that are partly subsidized by token incentives rather than real economic value.

When yields normalize and the airdrop farmers leave, we'll see what restaking really looks like. My guess is that it'll be smaller, more concentrated among sophisticated operators, and genuinely useful. But the path from here to there might involve some painful lessons for people who treated it like a risk-free yield upgrade.

The smartest money in restaking isn't the money chasing the highest yield. It's the money that understands exactly what it's risking.

Related Articles

An AI Wrote the Code That Just Drained $1.8 Million From a DeFi Protocol

A pricing glitch that lasted only minutes left DeFi lender Moonwell with $1.8 million in bad debt. The faulty code was co-authored by Claude Opus 4.6, an AI coding assistant. We've officially entered the era of AI-generated exploits.

Liquid Staking Protocols Now Hold More ETH Than the Beacon Chain Deposit Contract

Lido, Coinbase, Binance, and other liquid staking providers collectively control more staked ETH than solo validators. That concentration is both a success story and a ticking time bomb.

What Is MEV in Crypto and How It Affects Your Trades

MEV is the invisible tax on your crypto trades. Bots are making money off your transactions and you probably don't even know it. Here's how it works.