AI Agent Tokens Went from Zero to $5 Billion in Six Months

In mid-2025, the concept of an "AI agent token" barely existed. By the end of the year, the combined market cap of AI agent tokens had blown past $5 billion. That's a vertical line on any chart.

This is either the birth of a genuinely new category of crypto asset or the most elaborate marketing rebrand of chatbots since the last AI hype cycle. I think it's both, and sorting out which is which matters a lot if you're putting money in.

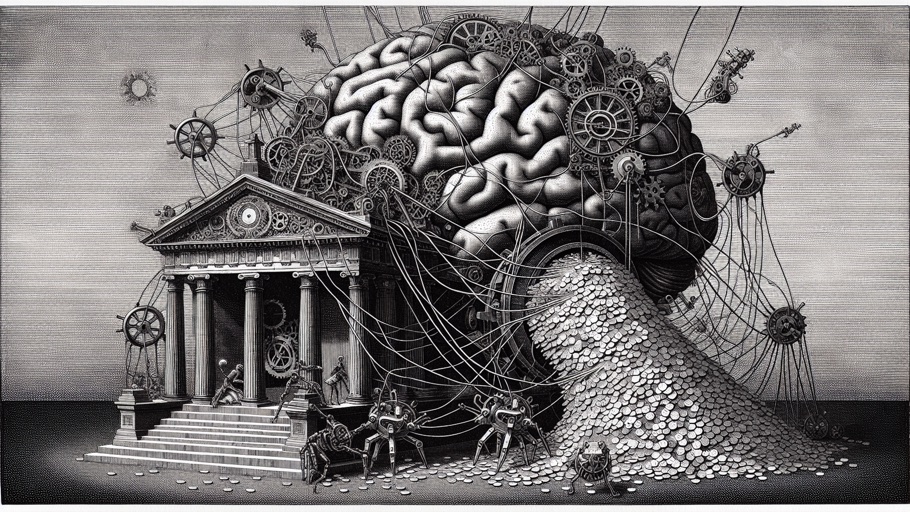

What AI Agent Tokens Actually Are

An AI agent, in the crypto context, is software that autonomously performs on-chain actions. It can trade. It can provide liquidity. It can participate in governance. It can interact with smart contracts. Some agents even manage their own wallets and make decisions about capital allocation without human intervention.

The tokens associated with these agents serve various purposes. Sometimes they're governance tokens for the agent's framework. Sometimes they're the currency that agents use to transact with each other. Sometimes they're just meme tokens attached to a chatbot with a Twitter account.

The space splits roughly into three categories:

Agent frameworks. Platforms that let developers create and deploy AI agents. Think of these as the infrastructure layer. They provide the tools, the runtime, and the coordination mechanisms.

Autonomous trading agents. AI systems that execute trading strategies on-chain. They analyze markets, identify opportunities, and execute trades across DeFi protocols. The pitch is that AI can trade better than humans, 24/7, without emotion.

Social agents. AI entities that maintain social media presences, create content, and interact with communities. Some of them have their own wallets and make on-chain transactions based on social signals.

The Bull Case

Let me steel-man this.

AI is getting dramatically better at agentic tasks. GPT-4, Claude, Gemini, and open-source models can now execute multi-step plans, use tools, and reason about complex situations. The jump from "AI that writes essays" to "AI that manages a DeFi portfolio" is smaller than most people think.

Blockchain is the natural environment for AI agents. Smart contracts are deterministic, composable, and permissionless. An AI agent can interact with any DeFi protocol on any chain without needing a bank account, a KYC process, or a human intermediary. The on-chain economy is programmable in a way that the traditional economy isn't.

If AI agents become significant economic actors (and the trend suggests they will), they'll need their own financial infrastructure. Token economies, payment rails, coordination mechanisms. The tokens being created now might be the early infrastructure for an agent economy that processes billions in daily transactions.

The Bear Case (And It's Strong)

Now let me be honest about what I actually see.

Most "AI agents" are glorified scripts. A bot that buys ETH when the RSI is below 30 isn't an AI agent. It's a trading script with a marketing wrapper. A lot of what's being sold as AI is simple automation dressed up with buzzwords.

The tokens are mostly narrative vehicles. When you buy an AI agent token, what are you actually buying? Governance over what? Revenue from what? Most of these tokens have no clear value accrual mechanism. You're buying exposure to the narrative that "AI + crypto = big number."

The social agents are cringe. An AI posting memes on Twitter and managing a wallet is entertaining for about a week. The novelty wears off fast. The tokens associated with social agents have the shelf life of memecoins because that's fundamentally what they are, memecoins with an AI gimmick.

We've seen this exact pattern before. Remember when every project was an "IoT blockchain"? Or a "supply chain token"? Or a "DeFi 2.0 protocol"? The AI agent narrative follows the same playbook: take a hot tech trend, slap a token on it, raise money, and hope the narrative holds long enough to find exit liquidity.

Separating Signal from Noise

The hard part is that there IS something real here, buried under layers of hype.

AI agents that actually execute useful on-chain tasks, such as portfolio rebalancing, yield optimization, cross-chain arbitrage, and liquidation management, could generate genuine value. The question is whether that value accrues to token holders or to the users and operators of the agents.

Here's my framework for evaluation:

Does the agent do something useful? Not "could it theoretically do something useful" but "is it actually doing something useful right now?" If the agent doesn't have measurable on-chain activity, it's vaporware.

Is the token necessary? Could the agent framework work with ETH or USDC instead of its own token? If yes, the token exists for speculation, not utility.

What's the revenue model? How does the agent or framework generate income? From trading profits? From subscription fees? From protocol fees? If the answer is "token emissions," it's a Ponzi with extra steps.

Who's the team? AI + crypto requires expertise in both fields. A crypto team that bolted on a ChatGPT API isn't building an AI agent. A machine learning team that doesn't understand DeFi isn't either. The intersection is small, and the genuine teams are obvious if you know what to look for.

The Concentration Problem

Here's an interesting dynamic. The AI agent token space has become extremely concentrated. A handful of tokens represent the vast majority of the $5 billion market cap. The top 5-10 projects command most of the attention, liquidity, and developer activity.

This concentration will likely increase. Unlike DeFi, where multiple competing protocols can coexist because they serve different functions, AI agent frameworks tend toward winner-take-most dynamics. The best framework attracts the most developers, who build the best agents, which attract the most users. Second-place frameworks struggle to attract talent and usage.

If you're going to invest in this space, the bar for choosing the right project is much higher than in DeFi, where diversification across several solid protocols is a reasonable strategy.

The Regulatory Wild Card

AI agents operating autonomously on-chain create novel regulatory questions.

If an AI agent executes trades for profit, is it running an unregistered fund? If it takes deposits from users and allocates capital, is it operating as a money transmitter? If it provides investment advice through social media, does it need to register as an investment advisor?

Current regulations weren't written for autonomous software agents with their own wallets. The answers to these questions will shape whether AI agents operate freely or get pulled into existing regulatory frameworks.

My Take

The AI agent narrative is 10% real and 90% hype. The 10% that's real, genuine autonomous on-chain software that creates value, is genuinely exciting and worth watching. The 90% that's hype, meme tokens with chatbot gimmicks, is going to zero.

The challenge is identifying which is which before the market figures it out. By the time it's obvious, the tokens for the good projects will already be expensive, and the tokens for the bad ones will already be worthless.

If I had to bet, I'd say that AI agents on-chain are a real trend that'll matter in five years. But most of the tokens created in the first wave of the narrative won't survive to benefit from it. The infrastructure plays have a better chance than the individual agent tokens. But even there, the risk-reward at current valuations requires conviction I'm not sure many investors actually have.

Proceed with extreme caution. And whatever you do, don't buy a token just because an AI told you to on Twitter.

Related Articles

An AI Wrote the Code That Just Drained $1.8 Million From a DeFi Protocol

A pricing glitch that lasted only minutes left DeFi lender Moonwell with $1.8 million in bad debt. The faulty code was co-authored by Claude Opus 4.6, an AI coding assistant. We've officially entered the era of AI-generated exploits.

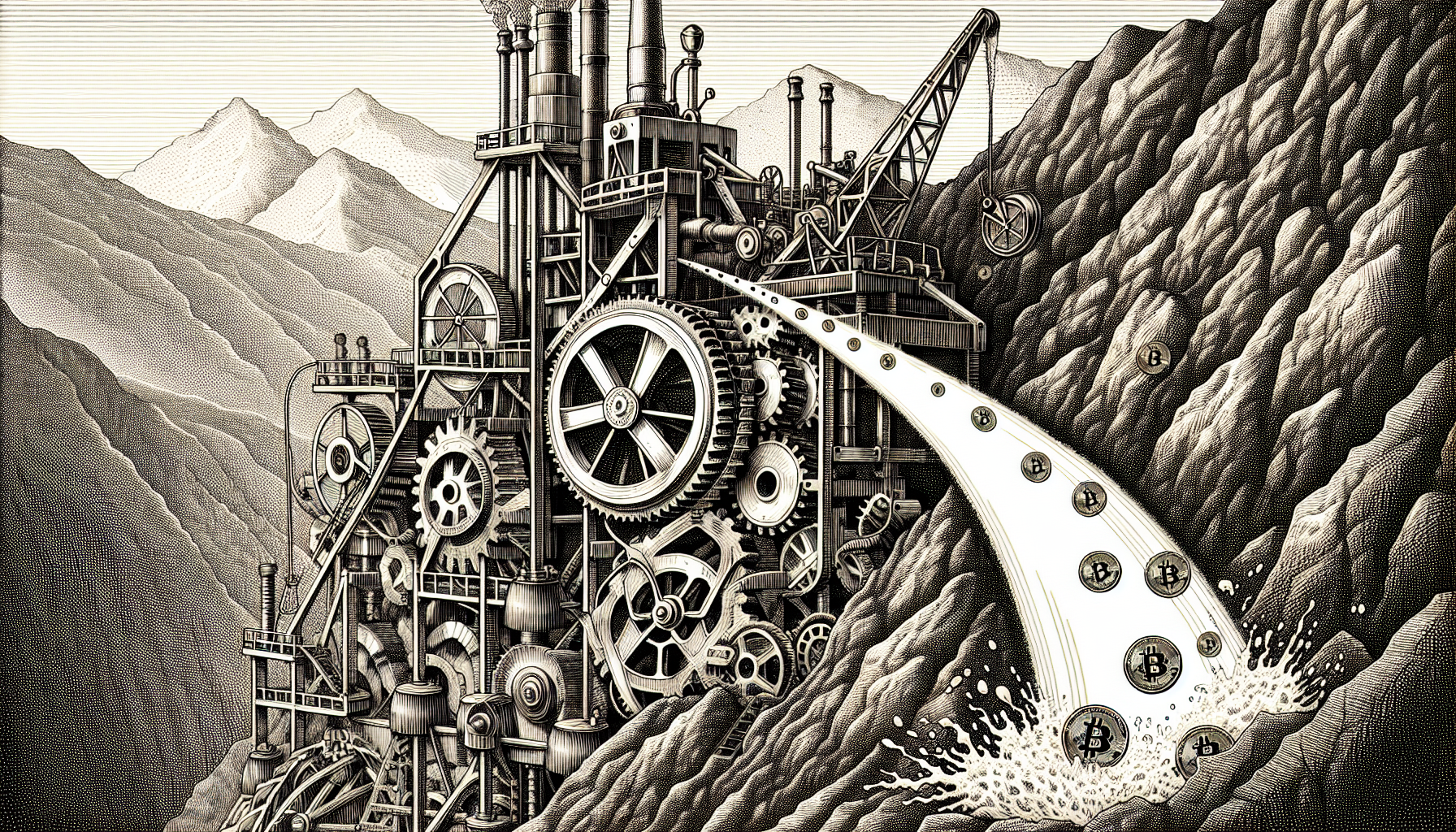

Why Bitcoin Miners Are Pivoting to AI and What It Means for the Network

Bitcoin miners are converting their facilities into AI data centers. The economics make sense. But what happens to Bitcoin's hash rate and security when miners chase a different revenue stream?

Bitcoin's Worst Start to a Year Ever. Here's Why Miners Don't Care.

Fifty days into 2026 and bitcoin is down 23%. That's the worst start to any year in its history. And yet mining difficulty just jumped 15%, the biggest single increase since 2021. Miners are coming back hard even as the price bleeds. So what gives?